How to – Apply for your Spanish Social Security Number

Why do I need it?

Every person who works for a registered company or is self-employed in Spain is required to have a Spanish Social Security Number, called anúmero de afiliación de la Seguridad Social. Social Security is generally paid for by an employer. This number also helps track pensions, unemployment and sick days, as well as maternity or paternity leave.

Any foreigner working or studying in Spain is entitled to a Spanish Social Security number, necessary for tax purposes as well as contracting and all procedures related to labor and work. Petitions are made at the Instituto Nacional de Seguridad Social, which also handles pensions, disability, motherhood and fatherhood, death and survival and public health care.

The Spanish Social Security system benefits all workers who are active within it. Each calendar day cotizado, that a worker has been employed, counts towards your Spanish pension and unemployment benefits, so be sure to check that your place of work has given you the activation, called an alta.

WHO CAN APPLY FOR ONE

Any citizen or worker, whether employed by another person or self -employed, who does not already have a social security number may request one.

The Employer must request the social security number of the person they intend to hire, if they do not already have one.

What is involved – Form TA1, must be signed by the applicant – which you can download here.

It looks impressive, especially if you do not speak Spanish, but is in fact quite easy to fill in if you know what you are supposed to do: give your name, ID details and reason for requesting for a social security number.

Fill the form to your best, and print another one for when you will go to the relevant office.

Help! How do I fill out the form?

Here’s the important information you’ll have to fill out:

Section 1: Personal data

1.1 : First Surname / Second Surname (if applicable) / First name

1.2 : Gender (M for mujer or female, V for varón or male)

1.3 : Type of ID (mark with an X): Spanish DNI number / Foreigner’s Card / Passport

1.4 : Number on your identification document

1.5 : Social Security number (if applicable)

Date of birth / father’s full name / mother’s full name

Place of birth / province of birth / country of birth

1.6 Disability (if applicable) / nationality /maiden name (if applicable)

1.8 Street Address

1.9 Email address /option to have information sent by text message / Mobile phone number

Section 2: Relevant Social Security Data

Mark with an X: Activation of Social Security / Number Assignment for Social Security / Change in data

2.1: Cause for data change (if marked X)

2.2 Listing of any accompanying documentation

Section 3: Option to have data sent to a second address added for communication purposes

At the bottom left, the solicitor and his or her employer must, write the place and date, then sign in this format:

En Sevilla, el 5 de julio de 2016

By filling out a form and presenting your original and a photocopy of a passport or another form of ID, you will be given a número de afiliación de la seguridad social. Keep in mind that you won’t be given an actual card like you might have in your home country, so be sure to keep the official form with your number for tax purposes.

Documentation needed –

- National ID and Passport if you have both,

- Residency papers:If you are a EU citizen, only the NIE number if you already have one. For non-EU, Residency and/or Visa.

- Not required officially but always good to have with you if you have them: rental contract, employment contract, escrituras if you have bought a property in Spain.

(always take 2 copies with you just in case they are needed, as these offices do not provide copying services)

Where is it processed

In Person – The application and documentation must be presented at the office of the Social Security Treasury General or Administration. which is local to the person or company applying for the number.

On-Line – By accessing the e-office´s “Allocation of Social Security Number” service, using a digital certificate

- Email:

This email address is being protected from spambots. You need JavaScript enabled to view it. - www.benidorm.org

- Teléfono: 966815454

- Fax: 966815501

03501 Benidorm (Alacant/Alicante)

The decision on the application will be made and the applicant notified within 45 days, after this period the application shall be understood as being accepted.

WHAT´S COVERED UNDER SOCIAL SECURITY

Health care is one of the biggest assets of being in the social security system, and your employer covers the necessary fee for your basic care. In most regions, general doctor visits and emergency care are free at public clinics and hospitals.

Prescriptions and surgeries are not covered under the social security umbrella and must be paid for after care has been administered, though often at a reduced cost. Note that dental care is not part of the social security system and must therefore be paid out of pocket. For more information, contact a social security office in your region.

Every autonomous region has its own regulations for the administration and compensation, as well as rules related to the type of contract you possess, so visit your nearest office or ask a lawyer.

Changing your UK Driving Licence to a Spanish Licence

Changing your UK Driving Licence to a Spanish Licence - This can be a complex subject to work through.

8th August - A reminder that if you are a resident in Spain and still not exchanged your UK driving licence you can only drive on your UK licence here until 15 September. Thereafter, you will still be able to exchange it but not permitted to drive here until you have the Spanish licence.

Not to be confused with those of you who have arrived since Brexit because you are allowed to drive on your UK licence for 6 months from your date of arrival

There are still a few appointments available in some DGT centres so get yours now.

Do not be fooled into thinking your IDP will suffice, it will not! It is not a stand-alone document, it must be accompanied by a valid UK licence.

Now that the process for you to exchange your driving licence is in place, please don’t forget the deadline. If you have a UK or Gibraltar licence, you can exchange your driving licence for a Spanish one without taking a practical or theory test. You should do this within 6 months from 16 March or within 6 months of the date you obtain your residence, whichever is later. After this your UK or Gibraltar driving licence will no longer be valid for driving in Spain. However, you will be able to exchange it for a Spanish one.

15th March 2023 - It’s finally happened, the driving exchange has been agreed according to an official interior ministry press release but DOESN’T come into force until the 16th so DON’T start driving yet. Official permission comes into force after confirmation has been published in the state Bolletin (The B.O.E)

Automatic translation

“The Council of Ministers has approved this Tuesday the agreement by which Spain and the United Kingdom will proceed to the reciprocal recognition and exchange of driving licenses as well as the exchange of information on traffic offenses in terms of road safety.

This agreement puts an end to the successive extensions applied to the exchange of permits between the two countries that had been applied since the end of the transitional period provided for in the Withdrawal Agreement of the United Kingdom from the European Union.

From now on, holders of a valid and current driving license issued by either of the two States may request the exchange of their equivalent driving license where they have established their residence, without being subject to any additional requirement of practical test or theoretical and according to the equivalence tables between the categories of permits from both countries.

The agreement establishes that all valid permits or licenses of current residents issued prior to its entry into force may be exchanged, while for permits issued after said entry into force it will be an essential requirement to access the exchange that the permits have been issued in the country where the applicant had his legal residence.

With this pact, those British citizens residing in Spain who had not had their driving license recognized before Brexit, nor in the successive extensions granted, will be able to do so as of Thursday, March 16th.

To facilitate administrative processing at the provincial traffic headquarters, a period of six months has been granted during which British citizens can circulate in Spain with their original permit while they process the exchange.

In addition, Spain and the United Kingdom undertake to provide each other with information on the data of the vehicles and their owners for the purpose of investigating traffic offenses related to road safety, especially in cases of speeding, not wearing a seat belt, failure to stop at a red light, driving while intoxicated, driving under the influence of drugs, not wearing a crash helmet, driving in a prohibited lane, or illegal use of mobile phones”

Changing your UK Driving Licence to a Spanish Licence

Process in brief

Take the psicotécnico test at a local testing centre (where they test eyesight, coordination and take a verbal survey of your general health, a more in-depth survey of your health is likely for those over 65 or exchanging higher categories).

Make an appointment at DGT under the appointment category for UK licences (Reino Unido), you will need to provide details of your UK driving licence, NIE, address etc

The DGT will contact DVLA to check your licence's validity. Once that comes back with a reply from DVLA then you will be able to proceed to DGT at the appointed time to continue the process.

You will need to take the appointment, at minimum: your Psicotécnico test result certificate, your TIE/residency certificate, passport, your old UK licence card, the application form, plus a Spanish size passport photograph, full list below.

Payment can be made by card at the DGT on the day. The payment can also be made prior to the appointment by the methods given via the link on the DGT page (see below).

You will hand over your UK licence and be given a temporary paper "cover note" in lieu of a licence. This is only valid for driving in Spain so bare that in mind if you plan to drive outside of Spain in the intervening period.

Your new licence card will be sent to you through the post or can be sent back to the DGT and be collected in person.

This link currently takes you to the page about UK licence exchanges, hopefully they will update this page with the new instructions and retain the same link so that it will still work once the updates have been made:

The process in full, with tips and details

Who can change a licence?

Any resident in Spain with a driving licence that has been issued in the United Kingdom of Great Britain and Northern Ireland. The request for exchange must be made by the permit holder or any person authorized on his behalf.

To authorize another person acting on your behalf, you can appoint a representative through our Register of powers of attorney.

You can also appear as long as you have the original DNI and a document signed by the interested party authorizing you to make the request, and where you express your free nature. To do this, download and fill in the DGT authorization model "Granting of representation".

If the procedure is going to be carried out by another person on your behalf, at the time of requesting the appointment at 060, you must indicate the ID of the interested party and also that of the authorized person

THE PSICOTÉCNICO TEST

This test is required every time a new licence is requested, so every 10 years for “ordinary” licence holders and more often for those with “professional” categories (PSV, HGV etc), for those over 65, and anyone with medical restrictions that mean their card has to be renewed more often.

The Psicotécnico test can be carried out at any testing centre that offers this service, search Psicotécnico on Google maps to find the ones nearest you (there are thousands of them in Spain). Generally speaking the closer you are to a DGT office the more expensive the test will be – and the more likely you will need an appointment. The test is normally around 25-35 euros.

At the test you will need to present your ID and residency card and make the payment.

The test includes the following:

Eyesight tests – if you wear glasses the test will be done first without glasses and then with glasses;

The coordination test - this involves controlling a pair of dots between two pairs of moving lines (“roads”) on a screen with a pair of joysticks. At the start of the test the lines move simultaneously but eventually the roads take different paths so you need to move each dot independently of the other. Much like the old wire and bell “steady hand test” found at village fairs, each time a dot hits the line a buzzer sounds, and that lowers the person’s score;

Questions about your current health – you will need to declare any medical conditions you may have and any medications taken. For those over 65 or those taking the test for professional level categories you may have a more in depth medical appraisal.

It is possible to still retain a licence even if you may have some types of incapacities as the licence can be limited to account for particular conditions – so for example a person may be prohibited from using motorways or from driving after dark.

Changing your UK Driving Licence to a Spanish Licence

Tips

If you normally wear glasses take them off while you wait for your appointment so your eyes can adjust a bit before taking the “without” glasses eyesight test.

Learn the Spanish alphabet as you will need to say the letters you see on the test card (it will only require the 26 “standard” letters of the alphabet, not the extra ones). However also note they usually have a test card for those who cannot read that have U shapes instead of letters. The “U”s that have the open side pointing either up, down, left or right, so if you are struggling to sound the letters they may move you on to that one – then you need to know just four words – up, down, left, right. Failing that you can point in each direction.

If you fail the coordination test it’s likely you’ll get additional tries at it – especially if this is the first time you have done one as they realise that this process is unusual for most non-Spaniards.

If you are wanting to change multiple categories then ensure that the examiner knows this as they may need to make a note of the categories you wish to swap over. The Psicotécnico test is the same for Categories A & B (motorcycle and car), known as a Group I test, but if you want your motorcycle category moving on to your Spanish licence just mention this at this test appointment (and definitely raise it at the DGT) otherwise it may not get added to the paperwork and so not appear on your new licence. The Psicotécnico test for the higher categories (a Group II test) is more complex so make sure that you are tested correctly for whatever categories you are going for or the certificate won’t be of any use.

The certificate is only valid for 3 months so bare that in mind for timings.

Changing your UK Driving Licence to a Spanish Licence

What you should know

The driving licences of residents in Spain that have been issued in the United Kingdom and Northern Ireland can be exchanged for an equivalent Spanish licence, when a series of administrative requirements are met:

- The driving license is not exchangeable if you have obtained it in your country of origin while already legally resident in Spain.

- Nor will it be exchangeable if you have obtained the permit after the signing of the agreement as a legal resident in Spain.

- Yes, it is exchangeable if the permit is expired after your entry into our country.

Driving licences issued by the authorities of the United Kingdom of Great Britain and Northern Ireland shall be valid for driving in Spain for a period of six months from:

- 16 March 2023, the date of provisional application of the agreement between the Kingdom of Spain and the United Kingdom of Great Britain and Northern Ireland on the mutual recognition and exchange of national driving licences and on the exchange of information on road safety-related traffic offences or

- the entry of its holder in Spain or

- The date of obtaining your legal residence in our country.

At the time of completing the procedure, the original permit will be withdrawn and a provisional permit will be given to you. In a period of approximately one month and a half you will have your final permit. You don't have to worry about going to your Traffic Headquarters or Office, it is sent to your home.

Before the day of the appointment at the headquarters, you must access the following web pages to obtain the verification code of your permit. This code must be communicated at the headquarters where you carry out the procedure so that its validity can be verified. If your permit has been issued by:

- The United Kingdom (DVLA) must access the following address: https://www.gov.uk/view-driving-licence.

- Northern Ireland (DVA) you must access the following address: https://www.nidirect.gov.uk/services/view-or-share-your-driving-licence-information

- In the case of Gibraltar (DVDL) it is not necessary to obtain the aforementioned code.

MAKE AN APPOINTMENT AT DGT

In person, delivering all the documentation in any Traffic Headquarters or Office.

- Must Request an appointment online or by calling 060.

- When requesting your appointment you must indicate in "Type of procedure" the option "Office procedures", once there select as processing area the option where the procedures referred to drivers are covered.

- We will not be able to assist you if you request an appointment in any other way.

Information about how to make an appointment for each foreign licence can be found by following this link, and selecting Reido Unido (or United Kingdom if you have the language selected to English – note that the order in the drop down list doesn’t change when translated so United Kingdom is up where the “R”s would be, not down at the very end)

Appointments can be made here (from Thursday 16th March onwards):

From the first drop down you will need to select the office you wish to make the appointment at, from the second select the type of appointment (which for UK licences should be “Canjes de permisos de conducción”). Finally you will be able to request the licence issuing country (Reino Unido) – at this current time that selection isn’t possible as there is no canje system for UK licences, but Reino Unido should be added to the list as soon as the BOE is released.

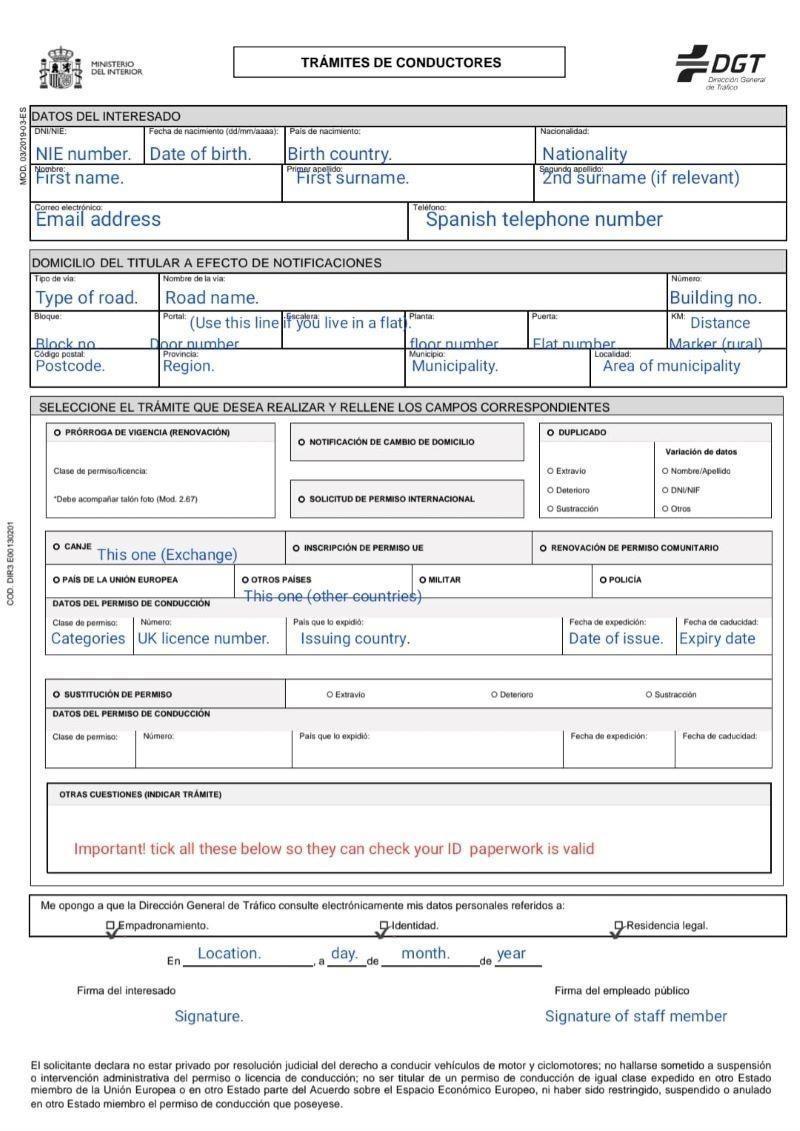

Once you have selected this it will move on to collecting your information, which, although we don’t know exactly at the moment, logically should be things like basic ID and contact information such as: NIE, first name, surname, (and second surname if relevant), UK driving licence number, and possibly an email address, postal address and Spanish phone number. I’ve attached an image of the form to this post that is commonly used for licence exchanges and it’s likely that if you have all the information for that form then you will have everything you will need for the appointment booking process.

Once you have submitted this initial information and request for an appointment information you will then need to wait for DGT to contact DVLA to get confirmation that you can proceed with the exchange.

Check the status of your request to exchange here.

This page should give you one of three results:

PENDING (pendiente): the applicant's country has not yet responded to the request for information made, continue waiting.

ANSWERED (contestada): the applicant may now go to DGT for their appointment to complete the application process (contestada doesn’t guarantee the licence will be granted, only that you may proceed with the process)

REJECTED (rechazada): the applicant's country has said it has no data for your licence, there should be information along with that rejection to let you know how to proceed if you get this result.

If you get a Contestado result then the system should offer a a selection of dates and times for you to choose from for you to travel to your selected DGT to present the required documentation.

The completed form which is probably the one other countries use for this or will be similar:

(the blank one can be found here: https://sede.dgt.gob.es/.../modelos.../03/Mod.03-ES.pdf), the image attached to this post should help you fill it in. This form includes a declaration that the right to drive motor vehicles and mopeds is not deprived by judicial decision and that they do not hold another EU or EEA license of the same class as the one requested, or that the licence has been restricted, suspended or annulled.

There are three boxes you can tick on this form (see red note on my image) – if ticked these give DGT permission to verify that you are on the padron, check your ID, and check you are correctly registered with immigration through their own channels. However, even if they are ticked DGT might not be able to get valid info so you might still need to provide documents to prove these (the second two are included in this list anyway but if you have a padron certificate available it’s always worth taking with you to any official appointment in Spain).

What will you need.

- Request exchange completed on official form, which includes a declaration that he is not deprived by a court decision of the right to drive motor vehicles and mopeds and that he does not hold another EU/EEA licence of the same class as the one applied for or which has been restricted, suspended or annulled.

- Identification of the interested party: Original in force to prove identity: DNI, residence card (foreigner's identity card), or valid passport.

- Accreditation of residency: Original of the DNI or residence card (foreigner's identity card) or certificate of registration in the register of EU citizens and any other document requested by the Headquarters where the exchange application is processed. In the official form you can expressly authorize the DGT to check electronically your registration address and the IAE. However, if the DGT does not obtain valid information, you must correct it by providing the documentation.

- Foreign driving license to be exchanged in force or expired if the validity date is later than the date of entry into our country. In the Provincial Traffic Headquarters you may be asked for the reports that, in view of the circumstances, are deemed appropriate in order to verify the authenticity, validity and validity of the driving license, in addition to compliance with the rest of the requirements.

- Verification code of your permit: Before the day of the appointment at the headquarters, you must access the following web pages to obtain the verification code of your permit. This code must be communicated at the headquarters where you carry out the procedure so that its validity can be verified. If your permit has been issued by:

- The United Kingdom (DVLA) must access the following address: https://www.gov.uk/view-driving-licence.

- Northern Ireland (DVA) you must access the following address: https://www.nidirect.gov.uk/services/view-or-share-your-driving-licence-information

- In the case of Gibraltar (DVDL) it is not necessary to obtain the aforementioned code.

- Psychophysical fitness report, issued by a Authorized Driver Recognition Center.

- Number or proof of payment of payment 2.3.

- Current original photograph of 32 x26 mm. in colour and with a smooth background, taken from the front with the head uncovered and without dark glasses or any other garment that may prevent or hinder your identification.

- If because of your religion you wear your hair covered, photographs with a veil will be accepted, but the oval of the face must appear completely uncovered from the hairline to the chin, so that it does not prevent or hinder your identification.

Psicotécnico aptitude report:

If the exchange does not require any theory and practical driving test - this is generally the case for exchanges of classifications A and B (Motorcycle and car) - a Group I Psicotécnico aptitude report is required.

If the exchange requires carrying out any theory &/or practical test (this may include those wanting to change categories C and D for UK licence holders although this is cannot be confirmed until BOE is released) it’s a Group II Psicotécnico aptitude report that is required.

Evidence that you have already paid the fee, or a debit/credit card to make the payment at the time of the appointment:

Payment - Fees to be charged:

Rate 2.3 (€28.87) for exchanges that do not require a theory or practical test (“straight swap”) – will cover car and motorcycle categories for certain. It MAY cover other UK categories as well, but we won’t know that until the BOE comes out.

Rate 2.1 (€94.05) for redemptions that require additional testing. In general, those foreign permits that include authorizations to drive type C and D vehicles - trucks and buses .

Current original photograph:

Passport size (32 x26 mm), in colour and with a plain background, taken from the front with the head uncovered and without dark glasses or any other item of clothing that could prevent or hinder your identification.

If, due to your religion, your hair is covered, photographs with a veil will be accepted, but the oval of the face must appear totally uncovered from the hairline to the chin, in such a way that it does not impede or hinder your identification.

Changing your UK Driving Licence to a Spanish Licence

WHAT HAPPENS NEXT?

If you are then granted a Spanish driving licence then at the end of this appointment you will be given a temporary cover note in lieu of your licence. This is only valid for driving in Spain so bare that in mind if you plan to drive outside of Spain in the intervening period. If your licence application is rejected for any reason you should be informed of your next steps at that point.

Your new licence card will be sent to you through the post or can be sent back to the DGT and be collected in person. It may be back in a few days or may take weeks, this is region dependent.

Tips

Your new licence should have 12 points on it (points work downwards here, i.e. they are taken off you for misdemeanours), after 3 years clean driving you will get 2 more points and after a further 2 years a final 15th point.

You can easily check details of your driving licence my downloading the MiDGT app as this will show all the details of your licence – the categories, points, the expiry date etc and the app also shows all your registered vehicles, insurance, ITV dates etc. It can be used to carry out a number of DGT process without having to go to the office. The MiDGT app is valid for police checks in Spain – i.e. you do not need to carry your licence and vehicle documents if you have the app and the vehicle is registered to you.

Frequently asked Questions and Answers

How long can it take for the new permit to get home?

The normally about a month and a half after the completion of your procedure you have your new permit already at home.

Until I get my new licence, can I drive?

Yes, for 3 months you can drive with the provisional permit. This provisional permit is delivered at the time of the procedure. In the case of duplicates, we will deliver it ourselves when we attend you at the window. If it is a renewal, it will be done by the medical center where you made the recognition and for issuance of new permits, it will be your driving school that facilitates it.

Can I drive outside Spain with the provisional permit?

No. With the provisional license you can only drive within our borders. If you are going to drive abroad you must apply for the International Permit, at any Traffic Headquarters or Office. In this case, you need Request an appointment online or by calling 060.

What do I do if I don't get the new permit?

After a reasonable time of the procedure we advise you to go to the Headquarters or Traffic Office where you did the procedure to inform us of the incident to see what has happened and send it back if necessary.

What is meant by normal residence?

The normal residence is the place where a person habitually stays, that is, for at least one hundred and eighty-five days for each calendar year.

Normal residence is understood as the permanence in Spain in a regular situation that must be duly accredited, in accordance with the provisions of the Organic Law 4/2000, of 11 January, on the rights and freedoms of foreigners in Spain and their social integration.

DISCLAIMER

Please note much of the above information has been translated from Spanish to English, some information/details may be slightly lost in this translation.

This information is provided as a guide only. Definitive information should be obtained from the Spanish authorities. Benidorm Seriously is not liable for any inaccuracies in this information.

Living in Spain Official information.

How To Register for Autonomo

How To Register for Autonomo - What is Autonomo?

Autonomo status is the Spanish equivalent of self-employed or freelance and in addition covers people operating (unincorporated) small businesses. Anyone engaged in any of these activities is obliged to legalise them with respect to registration, paying the taxes and charging IVA (VAT).

Autonomo will set you back costs of just under €300 monthly in social security payments, this figure is dependant upon age. This figure stays the same, it does not matter how much or how little you earn each month, (there’s a discount during the first two years), as well as 9-21% of your net profits in income tax. And don’t forget about VAT.

How To Register for Autonomo

News Updates 15th January 2022 Spain proposes new Social Security contributions for self-employed: From €184 to €1,267 depending on income

The plan, which is still subject to talks, will mean that freelancers pay according to what they earn rather than a flat monthly rate

Spain’s Social Security Ministry is continuing with its plans to reform how the self-employed make contributions to the Social Security system. Under its proposal, presented Thursday to business associations and unions, freelancers would pay monthly contributions based on their real income, rather than a fixed monthly amount regardless of how much they make.

Right now, with a few exceptions, it is possible to choose one’s contribution base, which in turn determines the monthly fee to pay, regardless of actual income. There is a minimum payment to make even for the lowest earners. Currently, an estimated 85% of Spain’s self-employed have opted for the lowest available contribution base, which is €944. This amounts to a monthly payment of around €250 or more for most freelancers.

The proposed reforms would dramatically change this system. According to sources close to the negotiations, the ministry has proposed creating 13 contribution brackets based on the self-employed worker’s income, ranging from €600 and to €4,050 a month. The self-employed in the lowest bracket would pay a minimum monthly fee of €184, while those who exceed the top bracket, would pay €1,267 a month.

The Spanish government – which is led by a coalition of the Socialist Party (PSOE) and junior partner Unidas Podemos – also wants to make the system more flexible, according to the same sources. Under the proposal, the self-employed would be able to change their income bracket up to six times in a year, on the understanding that freelance work fluctuates from month to month. In this way, a freelancer would be able to adapt their monthly Social Security contributions when they earn the most and when they earn the least.

According to the sources, the proposal estimates that two in three freelancers in Spain will pay lower Social Security contributions under the new system. The self-employed who earn between €600 and €900 a month, for example, will see savings of €600 a year. As for the €70 reduced monthly rate, the government plans to keep it in place, but wants to offer it primarily to freelancers who earn less than the minimum wage.

Information updated January 2021

If you do not have residency in Spain, from January 2021 you now need to apply for a SELF-EMPLOYMENT WORK VISA.

It does not apply to EU citizens or to nationals of countries to whom EU law applies, for being beneficiaries of the rights of free movement and residence.

NEED FOR RESIDENCY PERMIT IN THE UK It is an essential requirement to be in possession of a valid UK residence permit, and apply for a visa before moving to Spain. You must not be irregularly in the Spanish territory or within the period of no return to Spain that the foreigner has assumed when voluntarily returned to their country of origin.

JURISDICTION OF THE CONSULATE GENERAL OF SPAIN IN LONDON You can check if your place of residence is under the jurisdiction of the Consulate General of Spain in London through this website: http://www.exteriores.gob.es/Consulados/LONDRES/es/Consulado/Paginas/Demarcacion.aspx

APPOINTMENT REQUESTS Applicants must request their appointment through the following procedure: Sending an email to the following address:

In the SUBJECT they must specify the type of residence visa they wish to apply for. The TEXT of the message should state: -

PERSONAL DETAILS of the applicant (full name, nationality, passport number and telephone number) -

TYPE OF RESIDENCE VISA you wish to apply for. -

REASONS for the request. -

DESIRED DATE for the appointment at the Consulate General (only on TUESDAYS and THURSDAYS of each week, between 09:30 and 12:00).

The final date and time of the appointment will be confirmed through email. Applicants who wish to cancel their appointment are kindly requested to notify the Consulate as soon as possible. No applicant will be accepted without prior appointment, each appointment being only for one person, therefore, family members accompanying the applicant who wish to apply for a visa need to book an additional appointment. This Consulate General will not accept appointments that have not been requested in accordance with the aforementioned procedure. Both, the request for authorisation for self-employment work and the subsequent visa, must be applied personally, the application will only be accepted through a representative with a notarised authorisation, where there is justified reason or, in the case of minors, through their parents or legal guardians.

In the case of a positive answer, the applicant must collect personally their visa within one month from the date of notification. Failure to do so, it will be understood that they have renounced the visa granted, and the procedure will be closed.

The consular office, on the basis of a substantiated reason and in addition to the required documentation, reserves the right to request additional documentation or the personal appearance of the applicant without this implying the approval of the visa.

All official documents (birth certificate/death, marriage certificate/divorce, criminal record) must be legalised through the consular representations of the issuing country or, in the case of signatory countries to the Hague Convention of October 5, 1961, hold the Hague Apostille, except official documents issued by a Member State of the European Union, which will not require to be legalised. If your application is refused, you will not be refunded the fee you paid at the time of your application.

SUBMISSION DEADLINE The visa can be applied for up to 90 days before the desired date of entry into Spain.

REQUIREMENTS When applying for a visa, you must submit a photocopy of all the original documents that you want to be returned to you at the end of the procedure. This consulate does not make photocopies.

I. APPLICATION FOR AUTHORISATION FOR RESIDENCE AND SELF-EMPLOYMENT: 1. Fill in the EX-07 form of ‘Autorización de residencia temporal y trabajo por cuenta propia’.

2. Fill in the ‘Autorización inicial de residencia temporal’ fee self-assessment form 790-052, to be paid at the Consulate on the day your application is accepted.

3. Fill in the ‘Autorización inicial de trabajo por cuenta propia’ fee self-assessment form 790-062, to be paid at the Consulate on the day your application is accepted.

4. Valid passport or travel document, recognised as valid in Spain. It must have a minimum validity of the duration of the stay and at least two blank pages. Photocopy of all passport pages.

5. Work Permits or Licenses that sanction the building, opening and operation of the planned project or the professional activity, including the information regarding the stage of the process and, if corresponding, certificates of applications filed with competent authorities.

6. Business Plan of Activities that will be carried out, with the anticipated investments shown, your projected profits and the possible amount of jobs created and proof of sufficient economic funds, or contracts of investments or loans from financial institutions. There must be evidence of sufficient funds to establish and maintain employment indefinitely.

7. Proof of having the legally required professional qualification or sufficient experience of carrying on professional activity, as well as professional registration when required.

8. Proof of having sufficient economic funds for covering maintenance and accommodation costs. If the origin of these funds is the self-employed professional activity, it will be evaluated after discounting the necessary costs to cover the maintenance of professional activity.

II. VISA APPLICATION: In case the authorization for residence and self-employed work is granted, the applicant must personally apply for visa within ONE MONTH from receiving the notice of the authorization grant, providing the following documents: 1. National visa form complete, dated and signed. It can be downloaded free of charge on the website: http://www.exteriores.gob.es/Consulados/LONDRES/en/Consulado/Documents/Solicitud%20nacional%20ES.pdf

2. Recent passport photograph with white background. Information on the requirements to be met by photographs can be found in the ICAO document. This Consulate does not accept digital retouching on identity photographs.

3. Valid passport or travel document, recognised as valid in Spain. It must have a minimum validity of the duration of the stay and at least two blank pages. Photocopy of all passport pages.

4. Valid UK residence permit and photocopy. Visa applications submitted by non-residents who are in the UK on a C-Visit stay visa will not be accepted.

5. Certificate of criminal record (only in the case of persons over 18 years of age, criminal age in Spain) issued by the country or countries where the applicant has resided within the five years preceding the date of the visa application. It cannot be older than 3 months, unless the certificate itself specifies a longer expiration.

These certificates must be legalised through the consular representations of the issuing country or, in the case of signatory countries to the Hague Convention of October 5, 1961, hold the Hague Apostille, except official documents issued by a Member State of the European Union, which will not require to be legalised. Sworn translation into Spanish is also required.

6. Medical certificate, issued no later than 3 months prior to the date of application, it must be formulated in the following terms or similarly:

If the medical certificate is issued in the United Kingdom: “This health certificate states that Mr./Mrs. (…) does not suffer from any of the diseases that may have serious public health repercussions in accordance with what is stipulated by the International Health Regulations of 2005” Certificates issued in the United Kingdom must be accompanied by a sworn translation into Spanish.

If the medical certificate is issued in Spain: “Este certificado médico acredita que el Sr./Sra. (…) no padece ninguna de las enfermedades que pueden tener repercusiones para la salud pública graves, de conformidad con lo dispuesto en el reglamento sanitario internacional de 2005” The Consulate does not provide information about medical centres that issue this certificate.

The applicant may contact any public or private medical centre duly accredited in the territory of the United Kingdom or Spain. Medical certificates issued in countries other than the United Kingdom or Spain will not be accepted.

7. Pay the relevant visa fee at the Consulate on the day your application is accepted. (ENTREPRENEUR VISA - £966)

NOTICE: This information is intended to serve as a guide for visa applicants. While we try to make it as accurate and up-to-date as possible, Benidorm Seriourly does not assume any legal or other liability for its accuracy and refers to existing Schengen and national regulations.

How To Register for Autonomo

When do you have to register as autonomo?

If you are earning money in Spain and are not employed or conducting the business through a company. If the business is incorporated and is a "one person" company, then the sole director (administrador) will be classified autonomo in any case. If you are working for a Spanish company owned by someone else, then you should either have an employment contract with it or be invoicing the company for your services, which will require autonomo registration.

Unfortunately the rules are quite strict and for any earnings, autonomo registration is required.

Naturally enough this strict interpretation leads many people to accept cash in hand payments rather than register. The question then arrises - is it possible to declare the income for tax? The answer is no - unless you comply with the autonomo registration obligation to begin with, it is not possible to declare the income in your annual tax return. Nor is it possible to provide an invoice to the customer for your service and then for them to deduct the expense against their taxes. This is because there is no IVA threshold in Spain - all businesses and self-employed must charge IVA (though some activities and goods are exempt - and only registered businesses, autonomo or companies, can issue proper IVA invoices. In summary, there is no grey area, earnings are either fully legal or fully "black" - not invoiced and subject to IVA, unregistered and undeclared.

How To Register for Autonomo

What's involved?

FEEL this is all a bit too complex to handle on your own get a professional to help you with the process.

Registering autonomo is essentially a two step process: registering as self-employed with the tax office (Agencia Tributaria) and joining the autonomo social security system (Regimen Especial de Trabajadores Autonomos RETA). Both are reasonably straightforward and the only real requirements are -

There are no requirements to show any business plans, capital or prove professional qualifications. Joining the autonomo social security system RETA does require that you are already in the social security system and this involves another fairly simple registration process. Similarly the Agencia Tributaria would expect you to be registered as a resident taxpayer which involves completing a another form (Modelo 30).

That is the bare minimum requirement for registering as self-employed but there may be other steps to go through, depending on the type of business. For example anyone opening premises to the public will require an opening licence called a "licensia de apertura". This is obtained from the local town hall and will be granted according to local by laws, after passing an inspection by a municipal expert ("tecnico"), payment of fees, presentation of other documentation and certificates and undertaking any other remedial work demanded by the town hall (e.g. sound proofing, emergency exits, hygiene facilities). In practice hiring a private tecnico to assist with this process is normally required. It is important to note that the licensia does not belong to the building but to the person who took it out; therefore if you buy a business you will need to reapply for a licensia even if nothing has changed and you are operating from the same premises.

And then there are the ongoing obligations applicable to all autonomos,

How To Register for Autonomo

tax and VAT (IVA) returns on a quarterly basis

keep up social security payments (monthly)

issue properly drawn-up invoices, including IVA and - where appropriate - income tax retentions.

keep accounting records according to the legal standard including income accounts, expense accounts, supporting invoices for expenses and accounts of capital items, being goods used in the business with a life more than 1 year and which can be depreciated (expensed) over a period of time. These accounting records will be absolutely essential if you are selected for inspection by the tax.

How To Register for Autonomo

Choosing the right classification

There are two types of autonomo - commercial and trading businesses (autonomo empresarial) and professionals or freelancers (autonomo profesional). Within these broad classifications there are individual sub-classifications depending on the type of business or professional activity being undertaken. The Agencia Tributaria and Social Security offices both have their own classification systems. Many prospective self-employed people could choose which classification they are to be and they can have some important effects on the timing and structure of tax payments.

Deregistering / winding up

One of the positive things about the autonomo classification is that it is relatively simple to de-register. Use the same forms for registering (dar la alta in Spanish) to de-register (dar la baja), being the modelo 36 or 37 in the case of the Agencia Tributaria and the TA 521 for social security. As with registration, do the Agencia before the social security office who will want to see the de-registration for tax purposes before they will take you out of RETA. Failing to leave RETA properly by filling in the forms will expose you to continuing social security liabilities (just cancelling the standing order is not enough). Also remember that you will still have to do an annual income tax declaration (la Renta) in the year following your last year as an autonomo.

NOTE: once you de-register from RETA your health system card should still be valid for 3 further months.

How To Register for Autonomo

A BASIC STEP BY STEP GUIDE - if unsure employ a Spanish Accountant/Gestor

1) Getting the appointment: Cita Previa. Here, the system will guide you through the following steps:

(You should click on the link to understand these steps better)

- First they’ll ask you for identification – Identificación

- NIE number – IE: X-1234567-D

- Family Name – Primer Apellido (Spaniards have two)

- Then they’ll ask you to select a procedure – Selección Procedimiento. You’ll have to choose the option of Economic Activity Tax or Impuesto de Actividades Económicas (IAE), first by clicking on: Gestión Censal y acreditación certificado digital; and then: 036/037. IAE. NIF. Etiquetas y cambio de domicilio

- Now you have to choose your area – Selección Zona. You only need to enter your Post Code number (5 digit code. For example, Benidorms code is 53053.

- Finally, confirm your appointment! To set up your appointment with Hacienda, you’ll have to follow three more easy steps:

- Select a date – Selección Fecha

- Select a time – Selección Horario

- Click on: Confirmation – Confirmación

2) Signing up in Hacienda for Impuesto de Actividades Economicas (IAE)

Signing up for IAE used to be a tedious task. Today, but it’s surprisingly fast. You just need to show up with your ID and tell the civil servant that you want to become an autónomo. During this step, you are letting Haciendaknow that you would like to register as a freelancer by filling out Modelo 036 / 037.

The funcionario or civil servant will ask you two questions: when you would like to start your activity and what service you are going to offer. Then, he or she will provide you with an “Activity Code” (each profession has a category or code). If your Spanish is good enough, we suggest asking for specific information regarding your activity—IVA, specific retention, etc.

Here are the documents you must bring:

- NIE Document

- Social Security Number

- Bank Account Number

B) Obtaining your Electronic Certificate (Certificado Electrónico)

This will allow you to interact with Hacienda (pay taxes).

https://www.agenciatributaria.es/AEAT.internet/Ayuda/obtener_certificado_electronico.shtml

How To Register for Autonomo

What you need to do:

- Install the FRMT certificates.

- Then apply for your User Certificate. They will send a Code to your email.

- Prove your identity. Once you receive your code in your email, present your ID card at a Seguridad Social office.

- Finally, you will be able to download your User Certificate.

C) Becoming Autónomo in Seguridad Social’s eyes.

Last step — registering at Seguridad Social — isn’t as easy as it is with Hacienda. But not to worry; when it comes to getting paid, Spain is highly efficient.

By becoming autónomo in the Seguridad Social and starting to cotizar (‘to pay for social security’ in English), you will be covered by Social Security and you have access to the public health system.

What you need to do:

- Find your closest offices here.

- Fill out Modelo TA0521. There are workers at the info desk that will give you the form. Just let them know that you’d like to become an autónomo. They will also give you a piece of paper with a number.

- Once you see this number on the screen, you only have to give them the following information:

- Your Social Security Number

- Your ID card

- A copy of Modelo 036 / 037 (from Hacienda)

- FNMT-RCM code to prove your identity (the code that you received in the previous step)

For other information on Paperwork required to live in Spain, check out this section of the website

HOW TO GET YOUR NIE NUMBER

How to get your NIE number You now need to make an appointment on line, and you can now print and fill in the forms online using form 790, some people are still being sent to Alicante and some to the Benidorm Police office. Use this link - https://sede.administracionespublicas.gob.es/icpplus/index.html Please NOTE, this link does not work correctly from mobile devices.

You can of course pay someone to do all the hard work for you - We recommend 'Book your NIE Number Appointment today' https://mynie.co.uk

Once you have your appointment and paid the correct fee of 9.54€ (this fee has recently risen) the procedure below will still be the same.

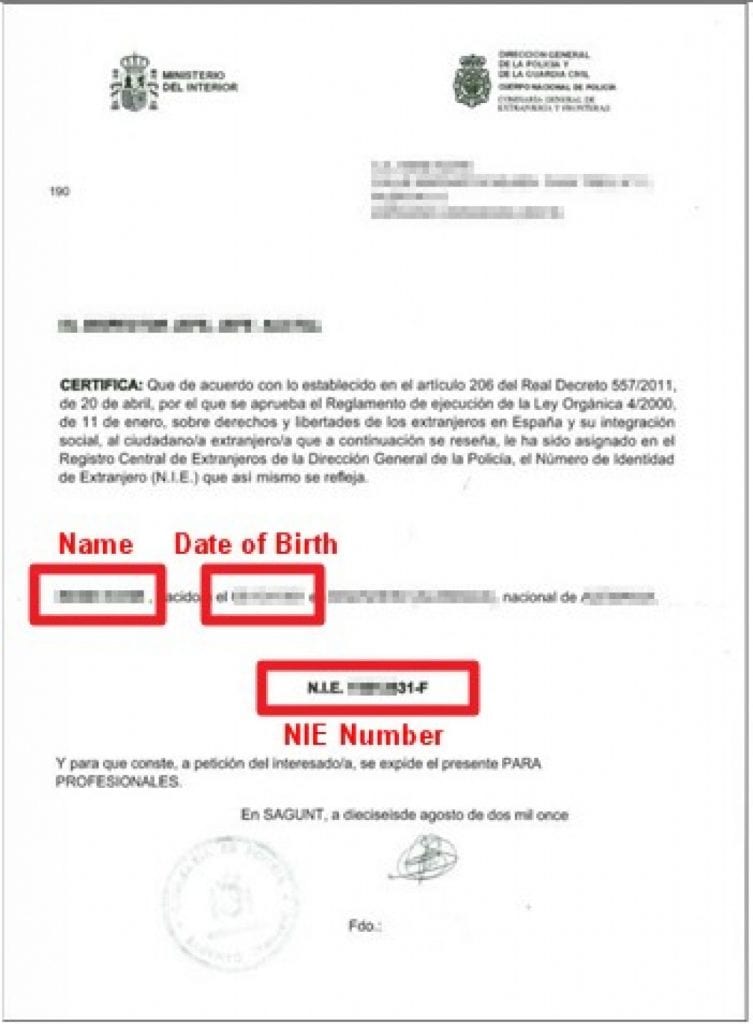

WHAT IS A SPANISH NIE NUMBER - Please note this is NOT Residency, which is now the TIE CARD

The Spanish NIE number, short for Numero de Identificacion de Extranero, is a Foreigner Identification Number issued by the Administracion General del Estado (General Administration of the State) and is a fiscal identification number for foreigners who want to stay more than 3 months in Spain, or in order to be able to process certain transaction in Spain like buying/renting a property.

The equivalent of NIE for Spaniards is the NIF (Numero de Identificacion Fiscal)

The NIE number is different from the Empadronamiento or Padron Municipal which is about getting registered in your living community.

The Spanish NIE number starts with a letter, followed by seven numbers and another letter in the end (example X – 1234567 – B). Each NIE number is dedicated to one person and it is neither transferable nor does it expire.

Why it is important?

The Spanish NIE number is basically used as a code to serve people who don’t have Spanish Nationality. It is of essential for virtually every activity that requires your identification. Many people are not aware of the real importance of the NIE number. For example, your very first steps after moving to Spain, like opening a bank account and getting internet/phone contracts, will require a NIE.

The Spanish NIE number is important for those who have a professional or economic interest in Spain.

WHAT YOU NEED YOUR NIE NUMBER FOR

Housing

o Buying or selling a home.

o Signing a mortgage loan.

o Property register and Notaries Public Offices.

Administration

o Local: census; certificates of occupancy of the home; property tax; vehicle tax; capital gains; works licences, business opening licences, etc.

o Justice: civil register, free legal assistance, etc.

o Health: health care card.

Social security

o Obtaining a social security number.

o Applying for services from the INEM (Spanish employment institute).

o Exportation of unemployment benefits from a Member State of the European Economic Space.

Economic relations

o Opening an account in a bank.

o Setting up a business or enterprise.

o Settling state and regional taxes: Income tax for non-residents (IRNR); corporate tax (IS); value-added tax (IVA, VAT); inheritance and gift tax (ISD), etc.

Others

o Buying a vehicle.

o Driving licence.

o Schools for minors, academic studies or university studies.

o Approval and certification of titles and studies.

o Grants and subsidies for studies.

o Electricity and water supply contracts.

How to get NIE number – step by step

Step 1: Make an appointment online.

You have to make an appointment online first before coming in person; otherwise you will not be served. To do that, click on this link and choose “Acceder al Procedimiento” at the bottom.

- In PROVINCIAS DISPONIBLES choose ALICANTE.

- In TRÁMITES DISPONIBLES PARA LA PROVINCIA SELECCIONADA choose CPN Asinacion de NIE

- Click Aceptar

- Click Entrar

- Fill in your information:

- Choose PASAPORTE and enter your passport number below

- Nombre y apellidos = name and surname

- País de nacionalidad = your nationality

- In Caracteres enter what you see on the picture above

- Click Aceptar

- choose your date and time

- add your email address, you will get a confirmation email sent to you with the time and date, print this off and take it with you

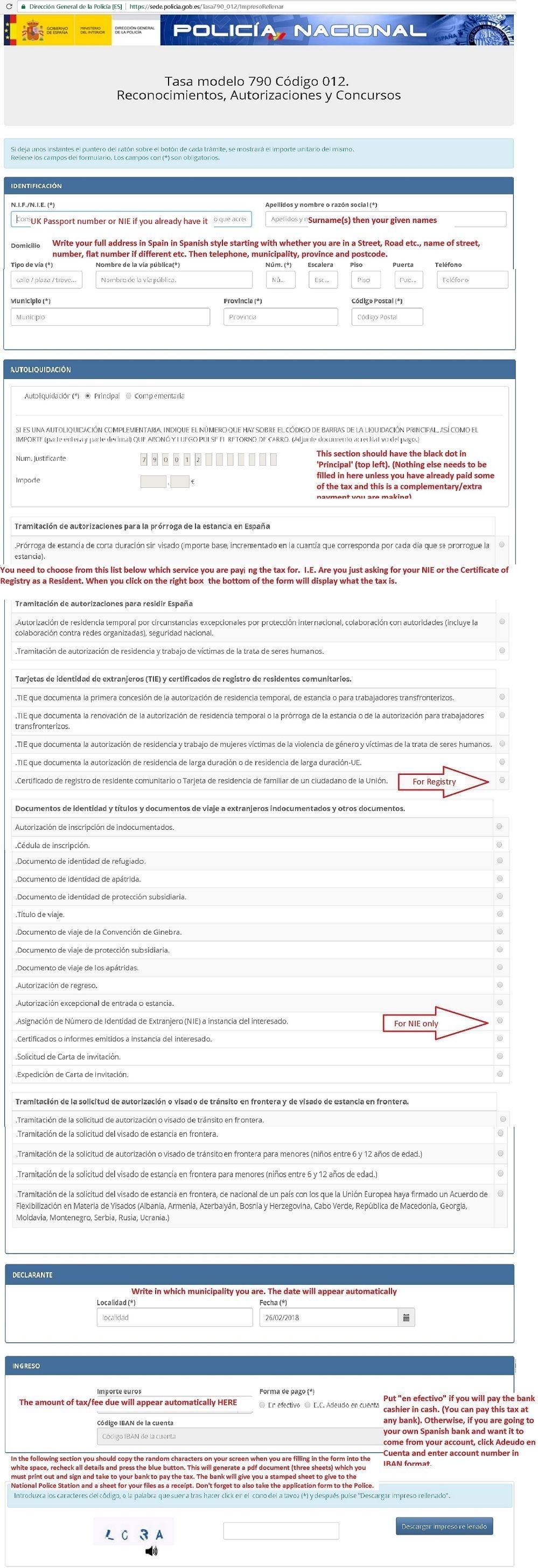

Step 2: Fill in form 790 HERE

Print all 4 pages and pay the necessary fee of 9.64 at the bank. Take your passport with you in case they ask for extra ID.

This form can now only be filled in online and printed out to take to the bank. It is no longer given out at police stations nor immigration offices and cannot be filled in by hand.

The form is very quick to complete and can be filled in by clicking here. You complete it then press the blue button at the end to get a copy you can print out and sign.

Guidance notes: As the form is in Spanish, below is some advice in English for guidance only (as at March 2018 and subject to change).

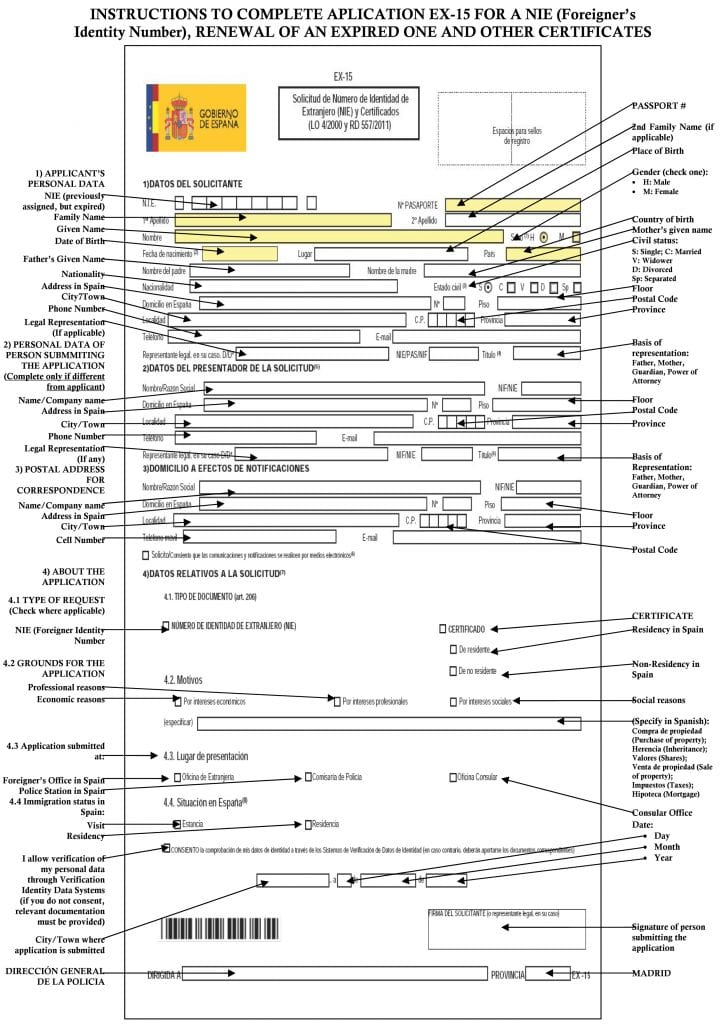

Step 3: Fill in the application form

The Spanish NIE number application form you need to find is called EX – 15 Solicitud de Numero de Identidad de Extranjero NIE y Cert .

The form will obviously be in Spanish.

HOW TO FILL IN THE N.I.E. APPLICATION FORM

1 DATOS PERSONALES means PERSONAL DETAILS

1er Apellido: Surname

2º Apellido : (second Surname) Write three chiffons instead (---)

Nombre : Christian Name (make sure to use same as in passport)

Fecha de Nacimiento: Date of birth (use two digits for day and month)

Lugar de nacimiento: Place of birth

Sexo : Gender “H” for Male (Hombre) and “M” Female (Mujer) . X cross the one applicable

Estado Civil: Status. S for single C for married. V for widow and D for divorced

País de nacimiento: Country of Birth

País de nacionalidad: Current Nationality

Nombre del padre: Father´s name

Nombre de la madre: Mother´s name

Domicilio en España: Address in Spain (if you have one, otherwise leave blank) - Localidad: Town, CP: Postcode, Provincia: Province

SECTION 2

Reasons for application:

Economic, Professional or Social (Tick professional for work reasons or social for house purchase)

3) DOMICILIO A EFECTOS DE NOTIFICACIONES

Leave blank

Sign the form at the bottom, under 'firma de solicitante'.

Step 4: Prepare all the necessary documents (checklist)

- Passport and copy of all pages

- Address in Spain

- Completed EX-15 formula

- 2 recent Passport photos

- copy of form 790 proving you have paid the fee

- Document proving why you need a Spanish NIE number, which differs depending on your intentions. In most cases it is:

- a contract showing that you’re going to buy a property in Spain like real estate, car, etc. or

- employed: job contract from the Spanish company or

- self-employed: a company ownership certificate or

- persons with sufficient funds: proof that you can live in Spain without working or

- students: acceptance letter from the school or

- job seekers: you can go only with passport, but you will be issued a temporary NIE number valid only for 3 months.

- non-EU citizens will need the additional proof of legal entry into Spain (for instance a landing card, known in Spanish as a declaración de entrada)

Step 5: Go to the authorized office

You can apply for NIE number at police stations with a Oficina de Extranjeros (Foreigners Office).

Benidorm Police Station -

Carrer Apolo XI, 31, 03501 Benidorm, Map HERE

Alicante Police Station -

Address: Calle de la Ebanistería, 4-6, 03008 Alicante

Phone: 965 01 93 00

Opening Hours:

| Tuesday | 9AM–2PM |

| Wednesday | 9AM–2PM |

| Thursday | 9AM–2PM |

| Friday | 9AM–2PM |

| Saturday | Closed |

| Sunday | Closed |

| Monday | 9AM–2PM |

#Useful tips: Get there early, even with the appointment system, as they will only allow so many NIE applications in one day. It is possible you will have to wait in the queue for hours until your turn at the office, so bring something that can keep you occupied for example a book or a magazine.

Step 6: useful Spanish terms

Some simple Spanish phrases that you might need:

Hello! I would like to apply for NIE number = Hola ! Me gustaría obtener mi número de identidad de extranjero (NIE) .

Where can submit my NIE application? = ¿ Dónde puedo inscribirme?

I have an appointment to get my NIE = Tengo una cita para obtener mi número de identidad de extranjero (NIE).

Step 7: keep calm and wait for it

After submitting all the documents, a photocopy of the application, a paper indicating when the card is available (keep it safe, you will need to show it to them later when you pick up your NIE card) and your passport will be returned to you. Usually after two weeks the NIE card should be available to pick up, but the process can sometimes take as long as 6 weeks. So stay patient! Generally in this area they take 1 week. Some NIE number are now being giving on the same day and you are requested to come back at a certain time.

Apply for NIE number before you come to Spain

It is also possible to apply for Spanish NIE number before coming to Spain, either by asking the Spanish consulate in your country or using a specialised agency of which many are available online, and the fees vary as well. But since you have read our guide, getting it all on your own won’t be such a pain.

What happens if I lose my N.I.E.?

Your N.I.E. is your life time number so it does not have to be renewed but if you lose it a duplicate must be obtained and you have to apply again in person. The procedure is the same as for a new application. Keep the original document in a safe place and have copies for everyday use. It is seldom that the original is requested

If I change my surname do I have to change my N.I.E?

If your surname changes due to marriage or divorce the N.I.E. must be re-applied for presenting your new passport or I.D. document at the National Police office in your locality. You will retain the same number but a new, correct, document will be issued.

If I change my address in Spain do I have to change my N.I.E?

NO - it is not necessary to change your actual N.I.E. document at the National Police office.

Applying for Spanish Residency

Official guidance on applying for Spanish Residency. This information has been proved by the UK.GOV and is correct at the time of publishing. Updated 1st January 2021

register your residency

This guide explains the registration processes you must complete as a UK national living in Spain. You must register both on the central register of foreign nationals (‘registro central de extranjeros’) and with your local town hall (‘padrón municipal’). Children must also be registered on both systems.

UK nationals who plan on living in Spain for more than 3 months must register as a resident and on the padrón at their town hall.

if you need assistance with any residency paperwork when here in Benidorm contact

If you are not already in Spain and planning the move you need to apply for a visa to obtain permission to live in Spain.

The cost of the visa to UK citizens is currently 516 UK pounds.

Note...This residence permit if granted, does NOT ENTITLE THE HOLDER TO WORK IN SPAIN.

British citizens and their family member need a visa for journey undertaken after 31st December 2020 for the purposes of residence, studies for period larger than 90 days, work, professional, artistic or religious activities.

Find more information on Visas HERE

UK nationals living in Spain before 1 January 2021

On 6 July 2020, the Spanish government introduced a new residence document for UK nationals living in Spain who have rights under the Withdrawal Agreement - the Tarjeta de Identidad de Extranjero (TIE). This biometric card explicitly states that it has been issued to the holder under the terms of the Withdrawal Agreement.

All UK nationals legally resident in Spain before 1 January 2021 have the right to request this card.

UK nationals who register as resident after 6 July 2020

If you register as resident after 6 July 2020 and are living in Spain before 1 January 2021, you must follow a two-step process to obtain your TIE. If you meet the requirements and your

If you register as resident after 6 July 2020 but were living in Spain before 1 January 2021, you must follow a 2-step process to obtain your TIE. If you meet the requirements and your application is approved you will be issued with the TIE. Children must also be registered and obtain their own TIE.

Read the Spanish government’s residency Q&A for further information on the residency process.

Applying for Spanish Residency

Step 1: Submitting your residence application

You must submit your residence application to the immigration office (Oficina de Extranjeros) in the province where you live.

You can do this electronically (if you have a digital signature ‘firma digital’), in person by appointment at the immigration office or via a third party representative who can submit your application, electronically or in person, on your behalf.

You will need to provide the following documentation:

- application form EX20

- passport

- documentation which demonstrates your residence in Spain before 1 January 2021

- documentation which demonstrates you meet the EU residence criteria on income and healthcare

Make sure you read the specific instructions provided when submitting your application online or when booking an appointment, on any additional documentation required in your province.

If you submit your application in person, many immigration offices will also require you to provide photocopies of official documents, such as your passport, at your appointment.

Submitting your application electronically

You can submit your residency application and supporting documents using the Spanish administration’s online platform (Sede electronica) as long as you have a digital signature:

- enter the online portal

- click ‘continuar nueva solicitud’

- choose ‘EX-20 - Documento de residencia Artículo 50 TUE para nacionales del Reino Unido (emitido de conformidad con el artículo 18.4 del Acuerdo de retirada)’

Submitting your application in person

To submit your application and documents in person, you must first request an appointment at the immigration office. In many provinces you must do this online via the public administration website:

- choose your province

- select ‘trámites oficinas de extranjería’ (if this option is available)

- choose the option ‘Trámite para la documentación de nacionales de Reino Unido (Brexit)’

In some regions this last option is not available and first time applicants should choose ‘solicitud de autorizaciones’ to request an appointment.

However, in the following regions you must contact the immigration office by telephone or by email.

- Malaga - call +34 95 298 04 60 and select OPTION 5 to request your appointment

- Seville - call +34 955 56 94 96 or email

This email address is being protected from spambots. You need JavaScript enabled to view it. to request your appointment - Barcelona - email

This email address is being protected from spambots. You need JavaScript enabled to view it. to request your appointment - Madrid - email the appointment request form, the EX20 application form and your supporting documentation to

This email address is being protected from spambots. You need JavaScript enabled to view it. - Valencia - email the EX20 application form and your supporting documents to

This email address is being protected from spambots. You need JavaScript enabled to view it.

If you are not sure how to request an appointment, contact the immigration office in your province.

Applying for Spanish Residency

CHILDREN

Children must also be registered as a resident. Even if your child was born and raised in Spain, they are not automatically Spanish citizens. As a general rule, a child born in Spain takes the nationality of his/her parents. Therefore, if you have not done so already, you should take steps as soon as possible to register them on the Spanish systems – both on the central register of foreign nationals (registro central de extranjeros) and with your local town hall (padrón municipal). It’s that back-to-school time of year, so do make sure all your family’s paperwork is in order and make sure your friends know what they need to do too.

Step 2: Applying for your TIE

Once your residency application has been approved by the immigration office you will need to obtain the TIE from the national police.

You must apply for an appointment online.

- choose your province

- then “trámites cuerpo nacional de policía” (if this option is available)

- then “Policía Exp tarjeta asociada al Acuerdo de retirada ciudadanos británicos y sus familiares”

You must attend this appointment at the police station in person with the following documentation:

- application form EX23

- passport

- proof you have paid the fee (via form ‘modelo 790, code 012’ – choose option ‘certificado de registro de residente comunitario’)

- photograph (you must ensure this meets the Spanish administration’s requirements)

Many police stations will also require you to provide photocopies of official documents such as your passport at your appointment.

You will need to return to the police station with your valid passport to collect the TIE once it is ready.

Read the Spanish government’s residency Q&A for full details of the application process and documentation required.

Applying for Spanish Residency

UK nationals who registered before 6 July 2020

If you registered for residency before 6 July 2020 and have a green paper residence certificate, you do not have to take action. Your green certificate (A4 or credit card-sized) remains valid and proof of your rights under the Withdrawal Agreement.

You may exchange it for the new TIE if you want to. The Spanish government recommends obtaining the TIE at it is more durable and may simplify some administrative processes. If you want to exchange your green paper certificate for the TIE there is no deadline for doing so.

To start the process you must apply for an appointment online.

- select your province

- then ‘trámites cuerpo nacional de policía’ (if this option is available)

- then ‘Policía Exp tarjeta asociada al Acuerdo de retirada ciudadanos británicos y sus familiares’

You must attend this appointment at the police station in person with the following documentation:

- application form EX23

- passport

- proof you have paid the fee (via form ‘modelo 790, code 012’ – choose option ‘certificado de registro de residente comunitario’)

- photograph (you must ensure this meets the Spanish administration’s requirements)

Many police stations will also require you to provide photocopies of official documents, such as your passport, at your appointment.

You will need to return to the police station with your valid passport to collect the TIE once it is ready.

Read the Spanish government’s residency Q&A for full details of the application process and documentation required.

Applying for Spanish Residency

Validity and renewal of residence documents

If you apply for the TIE and have been resident in Spain for less than 5 years, you will be issued with a temporary TIE, valid for 5 years. You can apply for a permanent TIE as soon as you reach 5 years total legal residence in Spain. You do not have to wait until the original card has expired.

If you apply for the TIE and have been resident in Spain for more than 5 years, you will be issued with a permanent TIE, valid for 10 years.

You must renew your TIE card if it is about to expire. You must do so in the month before or within 3 months after its expiry date.

Read the Spanish government’s residency Q&A for full details of the application process and documentation required.

How long can you stay out of Spain without risking your residency?

Did you know that under the Withdrawal Agreement (WA) there is a limit to the amount of time you be absent from your host state without losing our residence rights.

If you have permanent residence the permitted absence period is 5 years.

If you hold ordinary residence then the basic permitted absence is a total of 6 months in a 12-month period. This can be extended to “one absence of a maximum of twelve consecutive months for important reasons such as pregnancy and childbirth, serious illness, study or vocational training, or a posting in another Member State or a third country.” These are just examples and are not exclusive, if in doubt take legal advice from the consulate.

Register on the padrón

If you live in Spain you must register on the padrón municipal. This is a list kept by the town hall of all the people who live in that town.

You must register at the address where you normally live. You cannot be registered on the padrón (‘empadronado’) at more than one address.

You do not need to own a property to register, you can still register if you are renting or live with others.

Registering on the padrón municipal where you live is not the same as registering as a resident in Spain, which is a separate national register called the Registro Central de Extranjeros. See information in the sections above.

How to register on the padrón municipal

Padrón registries are managed by municipal authorities and town halls across Spain. The registration process may vary between regions. You may have to:

- request an appointment online (cita previa) to register in person

- submit your application online

Ask at your town hall or consult their website for information on the process to follow in your area.

You register on the padrón by filling in the form provided by your town hall (solicitud de alta). This form may be available to download on your town hall’s website.

Documents for the padrón

When applying in person or online, you will need to present your valid passport as official identification, as well as documentation which shows you live at the stated address such as:

- your NIE (numero de identidad de extranjero) or residence certificate / card

- the deeds to your house or a copy of your rental contract

- a recent utility bill in your name or proof of payment of municipal taxes

Your town hall will issue you with a certificate confirming your registration (certificado de empadronamiento). You may have to return to collect your certificate, but the authorities will complete your registration on the same day.

Some town halls may charge a small fee (for example, the fee in Palma de Mallorca is 1.20 euros).

Applying for Spanish Residency

Benefits of padrón registration

By registering you can:

- access public services and discounts

- access income-related benefits and social care

- receive a reduction in taxes

- get discounted travel if you are resident on a Spanish island

- vote in local elections

- register for local healthcare

- enrol children in school

- register a car with a Spanish number plate

Keeping your padrón up to date and de-registering

If you move house within the same municipality, you should request an appointment with your local town hall and update your details by requesting ‘cambio de domicilio’.

If you move to a different municipality, you must register (‘alta’) at your new address but you do not need to de-register from your old address (‘baja’) as it will be processed automatically by your new local authority.

If you decide to leave Spain, you should de-register by requesting ‘Baja por residencia’. Please refer to your local town for further information regarding de-registering procedures

How to request a duplicate copy of your padrón certificate

Once registered, you may find that you need to present a duplicate copy of your padrón certificate issued within the last 3 months when carrying out administrative processes in Spain. It is a requirement at some Extranjeria offices when registering as a resident. It may also be required at civil registries, social services, local education authorities etc.

There are many ways to request a duplicate padrón certificate:

- in person at your local town hall

- by completing an online form (if available on your town hall’s website) and requesting the certificate be sent by post to your registered address

- instantly online, if you have some form of official digital ID such as a certificado digital or by using the Cl@ve app.

You should check with your local authority for information on the options available to you.

Padrón status checks

You must confirm your padrón status every 2 or 5 years in order to remain registered.

If you have a green paper residence certificate (A4 or credit card-sized) or the TIE, your town hall will contact you every 5 years from the date you register to confirm that you still live in the town and wish to remain on the padrón.

If you don’t have a green paper residence certificate (A4 or credit card-sized) or the TIE, your town hall will contact you every 2 years. Your town hall will remove you from the padrón register if they are unable to confirm you still live in the town.

You can check with your town hall that you remain on the padrón register at any time.

Disclaimer

Please note this information is provided as a guide only. Definitive information should be obtained from the Spanish authorities. The Foreign, Commonwealth & Development Office (FCDO) nor Benidorm Seriously is not liable for any inaccuracies in this information.