Family members

Your close family members are able to join you and settle in Spain at any time in the future. Read more information on who this applies to in the Living in Europe guidance. They should apply online before moving to Spain (in Spanish) or through a third party in Spain, such as a lawyer. Alternatively, they can apply within 3 months of arrival to Spain.

Depending on their nationality, some non-EU family members may need a visa before travel. The Spanish authorities should issue Withdrawal Agreement family reunion visas free of charge.

Read the Spanish government’s guidance for ‘UK nationals and their family members residing in Spain’. This explains how you and your close family members can apply for the TIE and how to renew your TIE before it expires.

Appeal process

If your request to register under the Withdrawal Agreement is refused, read the refusal letter carefully. It will set out the decision, the reasons for it, and how to appeal. You have 1 month to appeal from the date of the refusal letter.

The appeal process usually has 2 steps:

- administrative appeal, where a different administrative authority reviews the decision

- court appeal

The outcome of an appeal is final. If you want to appeal, we strongly recommend you seek independent, specialised legal advice. The British Embassy cannot get involved in individual immigration applications and we cannot provide legal advice.

You can:

If you do not want to appeal, or do not meet the criteria to reside in Spain under the terms of the Withdrawal Agreement, you should consider other options:

Passports and travel

Coronavirus travel restrictions may affect may affect travel to and from Spain.

You can apply for or renew your British passport from Spain. The British Embassy does not issue passports.

Check the Spain travel advice for passport validity requirements.

Always carry your passport when travelling within the Schengen area. If you have citizenship of an EU or European Free Trade Association (EFTA) country, in addition to your British citizenship, you should enter and leave Spain using your EU or EFTA passport.

To be exempt from registering with the EU’s Entry Exit System (EES), British residents in the EU will be required to show a uniform-format biometric card which is listed as a residency document under the Withdrawal Agreement. For residents of Spain, that card is the TIE. The EES will be introduced by the EU in Autumn 2024. It will require third country nationals, including UK nationals, visiting the EU to create a digital record and provide their biometric data (fingerprints and facial image) at the border when they enter the EU’s Schengen Zone. It is expected that Green Certificate holders may face significant delays and difficulties at borders if they do not have a TIE. Contact the Spanish Government’s ‘Extranjeria’ offices for information on how to apply for the new TIE.

If you stay in Spain with a Spanish residence permit or long-stay visa, this time does not count towards your 90-day visa-free limit for the Schengen area.

If you visit other Schengen area countries outside Spain, make sure you do not exceed the visa-free 90 days in any 180-day period. You are responsible for counting how long you stay under the Schengen visa waiver, and you must comply with its conditions.

Different rules apply if you are travelling to other EU and Schengen countries as a resident of Spain. Check each country’s travel advice page for information on entry requirements.

If you were living in Spain before 1st January 2021

When you travel, carry your residence document or frontier worker permit issued under the Withdrawal Agreement, in addition to your valid passport.

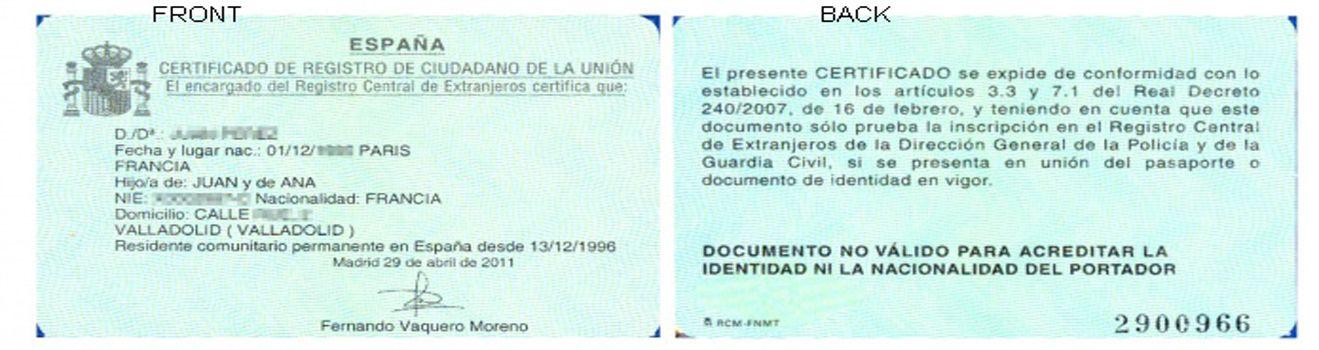

You must proactively show your residence document (the green A4 certificate or credit card-sized piece of paper or the TIE) if you are asked to show your passport at border control. If you have applied for, but not yet received, your residence document, show proof that your application is in progress.

To be exempt from registering with the EU’s Entry Exit System (EES), British residents in the EU will be required to show a uniform-format biometric card which is listed as a residency document under the Withdrawal Agreement. For residents of Spain, that card is the TIE. The EES will be introduced by the EU in Autumn 2024. It will require third country nationals, including UK nationals, visiting the EU to create a digital record and provide their biometric data (fingerprints and facial image) at the border when they enter the EU’s Schengen Zone. It is expected that Green Certificate holders may face significant delays and difficulties at borders if they do not have a TIE. Contact the Spanish Government’s ‘Extranjeria’ offices for information on how to apply for the new TIE.

If you cannot prove that you are a resident in Spain, you may be asked additional questions at the border to enter the EU. Your passport may be stamped on entry and exit. This will not affect your rights in the country or countries where you live or work. If a passport is stamped, the stamp is considered null and void when you can show evidence of lawful residence.

If you have rights under the Withdrawal Agreement, you can enter and exit Spain with a valid passport. You do not need any additional validity on the passport beyond the dates on which you are travelling.

Children travelling from Spain

Children (under 18 years old) resident in Spain, who travel out of Spain without a person who has parental responsibility, may need a certified authorisation by that person. This is required in addition to a valid travel document.

The regulation does not apply to foreign children resident in Spain who are subject to the law of their country of nationality, or to non-resident foreign children visiting Spain.

The Spanish immigration authorities are aware that there is no similar standard regulation in the UK, and therefore British consulates do not provide travel authorisation documents.

British children do not need written permission to travel unless they are subject to a court order which states that written permission is required from those holding parental responsibility. If the child is subject to such a court order, or to ensure that an unaccompanied child will be able to leave Spain without delay, you must obtain a certified authorisation from a public notary in Spain.

If you have parental responsibility for Spanish children in Spain, you can obtain a certified authorisation at a notary, national police station (in Spanish, or at the Guardia Civil (in Spanish).

Flight discounts for residents in Canary Islands, Balearic Islands, Ceuta and Melilla

Read the Spanish government’s guidance on who is eligible to access discounts on flights, and on how this has changed for UK nationals since 1 January 2021.

Healthcare

Read our guidance on healthcare in Spain and make sure you are correctly registered for your circumstances.

If you are resident in Spain, you must not use your UK-issued EHIC or GHIC for healthcare in Spain, unless you are a student or a detached (posted) worker.

Travel insurance is also not intended to cover healthcare costs if you live overseas.

Read the Spanish government’s guidance on access to healthcare.

You should also read our guidance on: finding an English-speaking doctor in Spain, travelling with medicines

Working in Spain

If you are planning to move to Spain and work, you must apply for the appropriate visa. Application processing times vary and you should only make travel arrangements once your visa has been issued.

Read the Spanish government’s guidance on:

Read the guidance on visas and applying for a visa at the:

To apply for a job, you may need to provide a:

Read:

If you plan to work in Spain, even if you work for a UK-based company, this may affect where you pay National Insurance-type contributions. Read the National insurance and social security contributions section for more information.

If you were living in Spain before 1 January 2021

You have the right to work without a visa, under the Withdrawal Agreement. You can use your TIE or green A4 certificate or credit-sized piece of paper as proof of your right to work.

If you live in Spain and were regularly commuting to work in another EU or EFTA country before 1 January 2021, read our guidance for frontier workers.

Professional and academic qualifications

You may need to get your professional qualification recognised if you want to work in a profession that is regulated in Spain.

Read guidance on:

Recognition and legalisation of UK academic documents

If you need your UK academic qualification officially recognised in Spain, follow the Spanish Ministry of Education’s guidance (in Spanish).

Your degree certificate or other documents need to be certified by a UK notary public and then legalised by the FCDO Legalisation Office. This legalisation service is not provided by the British Embassy in Madrid, UK consulates in Spain, or the British Council in Spain.

Read guidance on getting your UK degree qualification certified and legalised in the UK.

If you were living in Spain before 1 January 2021

If the relevant regulator in Spain officially recognised your professional qualification before 1 January 2021, or you started the recognition process by this date, make sure you understand the terms of your decision. You should get advice from the relevant regulator.

Studying in Spain

If you plan to study in Spain, carry out an internship or take up a placement as a language assistant, you must meet all visa requirements before you travel.

Contact the relevant higher education provider in Spain to check what fees you may have to pay.

Read guidance on:

If you were living in Spain before 1st January 2021

The studying in the European Union guidance includes specific information for those who were already living in Spain before 1 January 2021.

Money, tax and banking

The UK has a double taxation agreement with Spain to ensure you do not pay tax on the same income in both countries. Ask the relevant tax authority your questions about double taxation relief.

You should get professional advice on paying tax in Spain. Find an English-speaking lawyer in Spain or you can use a registered ‘gestor’.

Read guidance about:

National insurance and social security contributions

National Insurance-type contributions (NIC) are called ‘social security contributions’ (SSC) in Spain. Find out if you need to pay National Insurance in the UK or social security contributions in Spain.

If you plan to move to Spain and work, even if you continue working for a UK-based company, you and your employer may need to pay social security contributions in Spain. These social security contributions would entitle you to certain benefits, such as healthcare, in Spain.

Read guidance on National insurance for workers from the UK working in the EEA or Switzerland.

Check your UK National Insurance record.

Declaring your assets

As a Spanish resident, you must declare your global income to the Spanish authorities, no matter which country it came from. If you are not a resident, you will only pay tax on income that came from Spain.

You may need to file an annual declaration of overseas assets called a Modelo 720. There are severe penalties if you do not file, or give incorrect or incomplete information.

National insurance and social security contributions

National Insurance-type contributions (NIC) are called ‘social security contributions’ (SSC) in Spain. Find out if you need to pay National Insurance in the UK or social security contributions in Spain.

If you plan to move to Spain and work, even if you continue working for a UK-based company, you and your employer may need to pay social security contributions in Spain. These social security contributions would entitle you to certain benefits, such as healthcare, in Spain.

Read guidance on National insurance for workers from the UK working in the EEA or Switzerland.

Check your UK National Insurance record.

Benefits

UK Benefits

Read our guidance on entitlement to UK benefits and pensions while you are living in Spain.

If you are moving or retiring abroad, you must tell the UK government offices that deal with your benefits, pension and tax.

Check which benefits you can claim while abroad and how to claim them.

Many income-related benefits such as Pension Credit and Housing Benefit cannot be paid if you’re abroad for more than 4 weeks.

You can request proof from HMRC of the time you’ve worked in the UK and of your UK National Insurance record.

Spanish benefits

You may be entitled to Spanish benefits. To find out if you are entitled to Spanish benefits and how to claim, you can:

Pensions

Read our guidance on entitlement to UK benefits and pensions while you are living in Spain.

If you are moving or retiring abroad, you must tell the UK government offices that deal with your benefits, pension and tax.

Read our State Pension guidance if you have lived in Australia, Canada or New Zealand and you are claiming or waiting to claim your UK State Pension.

If you retire in Spain, you can claim:

Read the Money and Pension Service’s MoneyHelper guidance on pension and retirement changes for more information on cross-border pensions.

Life Certificates for UK State Pensions

If you get a ‘life certificate’ from the UK Pension Service, you must respond as soon as possible - your payments may be suspended if you do not.

Money and banking

Whether UK banks can provide service to customers living in the EEA depends on local laws and regulation.

Read the Money and Pension Service’s MoneyHelper guidance on banking, insurance and financial services for more information on cross-border banking.

Accommodation and buying property

Read guidance on how to buy or let property in Spain.

Driving in Spain - Updated 4th August2023

Read the guidance on:

You cannot renew or replace your UK, Gibraltar, Jersey, Guernsey or Isle of Man driving licence if you live in Spain.

If you have one of these licences, you can use it to drive for up to 6 months after becoming resident in Spain. To continue driving after this, you must apply for a Spanish driving licence.

The process for obtaining a Spanish licence depends on whether you have a UK, Gibraltar, Jersey, Guernsey or Isle of Man licence.

You cannot use an International Driving Permit (IDP) instead of a Spanish licence.

From 16 March 2023 you can drive using your valid UK or Gibraltar licence until 15 September. This is a temporary measure that the UK and Spanish governments have agreed.

If you have a valid UK or Gibraltar driving licence

If you were living in Spain before 16th March 2023, you can use your valid UK or Gibraltar driving licence to drive in Spain for 6 months from this date (15 September).

UK or Gibraltar licence holders who moved to Spain before 16 March 2023 and fail to make the exchange by 15 September will no longer be able to drive on their UK licence and will need to wait until their licence exchange has been completed to drive after that.

If you move to Spain after 16th March 2023, you can drive using your valid UK or Gibraltar licence for six months from the date you acquire residency. We recommend you start the exchange process during this time.

Exchange is possible after six months, but your UK licence will not be valid for driving in Spain while you await your exchange to be completed.

Read:

You will need to present a ‘check code’ from the DVLA, along with other documentation, at your appointment. If you have problems obtaining a check code, contact the DVLA on +44 300 083 0013.

If your licence was issued in Northern Ireland, read Northern Ireland government guidance to obtain the check code. If you have problems obtaining a check code, This email address is being protected from spambots. You need JavaScript enabled to view it..

If your licence was issued in Gibraltar you do not need a check code.

Expired UK or Gibraltar licences

Spanish authorities will exchange your expired UK or Gibraltar licence for a Spanish one if it was valid when you entered Spain. You cannot drive on an expired UK licence.

Some UK licence holders with expired UK driving licences (primarily those over 70) have been experiencing issues when trying to exchange their licence for a Spanish one.

The Department of Transport has been working to resolve this issue with the Spanish Government and can confirm that Spain’s Traffic Authority (DGT) will be able to exchange expired UK licences, as long as they expired after the individual moved to Spain.

A digital “check code” to enable the DGT verify these licences is available via gov.uk.

If your licence was issued by Jersey, Guernsey or the Isle of Man

You cannot currently exchange your Jersey, Guernsey or Isle of Man licence for a Spanish one. You must apply for a Spanish licence as a non-EU national. This includes taking both a theory and practical driving test.

Disabled drivers

If you have a UK Blue Badge and live in Spain, you must return it to the original UK issuing authority. You can apply for a new Spanish disabled parking card. The process is different in each region of Spain. Contact your local town hall or social services department for further information.

Read the EU guidance on the EU parking card for people with disabilities.